Factors That Affect Currency and Foreign Exchange Rates

Introduction

There are many factors that can cause currency changes, fluctuations and exchange rate determination. Foreign exchange rates can be unpredictable and there are many factors influencing exchange rates. As one of the key indicators monitored closely in the finance world, it is important to know why such changes occur. The exchange rate can often be used as an indicator to determine the health of an economy.

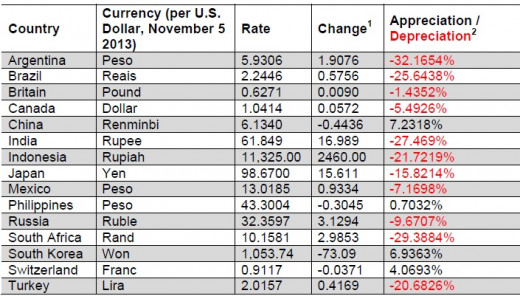

The image below details how much exchange rates can fluctuate in just a short span of 3 years.

Gross Domestic Product (GDP) and Economic Growth

The Gross Domestic Product is the total market value of all goods and services in a country. Thus, the Gross Domestic Product is an excellent and commonly used indicator to measure a country’s economic growth. If there is an increase of GDP, the national currency will appreciate as well. For example, between early 2011 to mid-2013, the real GDP of the U.S. increased from 15,052 to 15,679 billion dollars, a reason why the U.S Dollar appreciated against most foreign currencies during that period.

Interest Rates

Interest rates are a key factor to fluctuating exchange rates and adjusted by the central banks of respective economies. Higher or increasing interest rates provide higher returns for potential investors. This is commonly described as "hot money flows". Thus, this would attract foreign capital and result in an appreciation of the currency.

On the other hand, low or decreasing interest rates will cause the currency to depreciate as it will become less favorable to save money. This will decrease demand for the currency as spending (supply) increases. In addition, lower interest rates also encourages borrowing that can cause inflation to increase.

Inflation

A country with a lower inflation rate will have an appreciating currency due to increase in purchasing power. For example, one of the reasons of the strong Franc is due to Switzerland’s low inflation rate. It has a Consumer Price Index of -0.70 in 2012, the lowest among 64 countries ranked.

On the contrary, high inflation will devalue the currency. For example, Argentina has one of the highest inflation rates in the world, believed to be as high as 30% (figures wildly vary depending on source). This has contributed to the steep depreciation of the Peso against the U.S. dollar, from $4.02 in February 2011 to $5.93 in November 2013. This is a depreciation of more than 32% in the Argentinian Peso vis-à-vis the U.S. Dollar in less than 3 years.

Balance of Payment and Balance of Trade

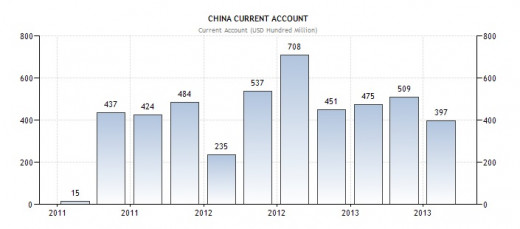

The balance of payment describes all financial transactions of a country. In general, a deficit would cause the currency to depreciate and a surplus would result in the opposite. For example, China has an active balance and surplus which contributes to the appreciating Renminbi.

The balance of trade describes the difference between a country’s exports and imports. A positive balance of trade means a trade surplus (i.e. more exports than imports) which increases currency value. This is because of increased demand in the country’s currency. The reverse, a trade deficit, will result in currency depreciation due to an outflow of monetary payments

(i.e. increasing supply) to other countries.

Public Debt

Deficit Financing or large-scale borrowing in layman's terms are usually performed by governments globally to engage in projects and funding. This has the benefit of stimulating the economy such as by creating jobs. However, a large amount of debt and deficit can be undesirable and a push factor for any potential investors.

This is because public debt and deficit can have undesirable consequences on the economy such as inflation. The debt crisis that occurred in Greece in 2008 was a result of such government deficits to finance various sectors such as the military. Eurostat estimated the huge debt has reached 15.6% of GDP in 2009, the highest among all countries in the European Union.

Political and Economic Stability

The political and economic stability of a country affects the currency value. Problems such as political turmoil and crimes can affect investors’ confidence as they look to invest their capital in other countries.

For example, in a survey conducted by Grant Thornton, it was revealed that 67% of private businesses in South Africa are withholding investment decisions due to political instability in the country. South Africa is also plagued with crime and security problems that can affect its currency value, highlighted by a -29.3884% depreciation since 2011.